By: Tallon Martin, Broker Associate

As we make the jump from 2023 to 2024, taking stock of the past year feels like flipping through the pages of a dynamic story. If I had to sum it up in one word, it would be “price.” The market spent the year in a quest to find the appropriate pricing. One submarket market has found it while the other is still searching. I kicked off 2023, experimenting with creative marketing ideas to make my listings stand out. I was able to generate some inquiry traction but getting buyers to commit was difficult. Inventory was robust and buyers were waiting to see which Sellers would show signs of openness to negotiate. As the year progressed, I discovered it was all about the price tag for turning heads and sparking offers. At least in some markets, but as you will see below, we are still searching for market value in some areas of the State. That’s my on-the-ground perspective, but let’s dig into the Q4 numbers to get the full scoop on how the Texas recreational land scene played out from a data standpoint.

Gillespie, Blanco, Burnet Submarket (Western)

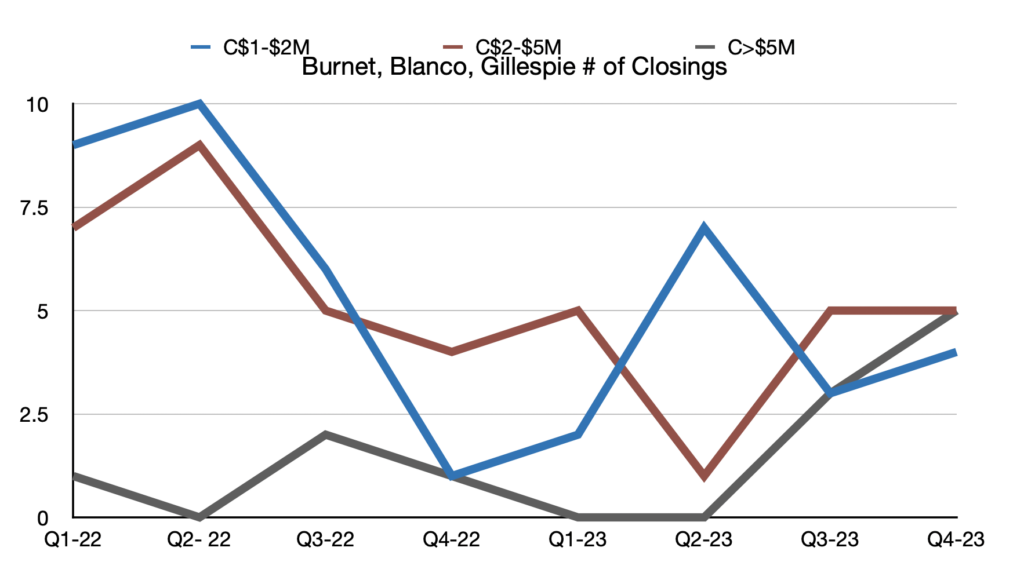

The western submarket wrapped up the year on a solid footing, with the fourth quarter standing out as the pinnacle of the year’s performance. The $1-2M bracket witnessed a notable 33% increase from Q3 to Q4, while the $2-5M segment maintained a consistent transaction count between the two quarters. The $5M+ market, however, stole the spotlight with an impressive 67% upswing from Q3 to Q4. What caught my attention the most was the gradual acceleration of the $5M+ market over the year. The initial two quarters were dead, a slight uptick emerged in Q3, and then Q4 witnessed a remarkable five-fold increase from Q1. A noteworthy comparison to Q4 of 2022 reveals a four-fold surge in $5M+ transactions during Q4 of 2023, portraying a robust and healthy trend over the past three years in this category.

Adding to this positive report card is the average time of sale for these $5M+ properties, clocking in at an impressive 5.57 months—a stark contrast to the state average of 18 months from the initial listing date to sale. Based on the data’s narrative, if you own a substantial asset in the hill country and are contemplating a sale in the next 12-24 months, 2024 appears to be a promising year to enter the market.

Another critical metric in my monitoring toolkit is the tally of active listings. Within the Hill Country submarket, inventory levels have been on a gradual ascent since the post-Covid land rush. From Q1 2022, this upward trajectory doubled by Q2 of 2023. Q3 maintained this doubled rate, but Q4 introduces an intriguing shift in the landscape, depicting a decline of approximately 38% in the $5M+ range, a 10% reduction in the $2-5M market, and a 4% drop in the $1-2M category. A noticeable surge in withdrawn listings during Q4 caught my attention. Upon closer examination, it became apparent that only two of these withdrawn listings resulted in a sale. This leads me to speculate that sellers, possibly frustrated with a lack of traction at their initially desired prices, chose to withdraw rather than align with the evolving market dynamics. A key takeaway from the data is that 2023 underscored the importance of realistic price expectations; those sellers who recognized this reality were rewarded with increased buyer interest and successful transactions.

Bastrop, Lee, Milam Submarket (Eastern)

In contrast to the Western submarket, the Eastern counterpart experienced a notable deceleration in Q4. While October exhibited robust activity, creating an initial impression of momentum carrying into November and December, transactions came to an abrupt standstill early in November. The overall transaction volume across all three tracked brackets witnessed a 14% decline from Q3 to Q4. The $1-2M range remained relatively stable throughout the year, maintaining an average of six transactions per quarter. However, the $2-5M range witnessed a slowdown, halving its pace by the fourth quarter compared to the numbers observed in Q1. The $5M+ market remained subdued throughout the year in this submarket. Noteworthy shifts include the $1-2M range doubling in Q4 2023 compared to Q4 2022, while the $2-5M range experienced a 33% decline in Q4 2023 compared to the same period in 2022.

Examining the active listing figures in the Eastern submarket, a striking 39% surge was observed in the $5M+ range from Q3 to Q4, while the other two price brackets remained relatively unchanged. Reflecting on Q1 2022, where the total active listings across all three ranges stood at 147, the conclusion of Q4 2023 we are in a much different spot with a 150% escalation in inventory, now totaling 369 active listings. This substantial increase in supply, coupled with a demand that does not quite match the inventory surge, is poised to impact prices. Drawing from my personal encounters with several listings in this region, efforts to pinpoint the sweet spot in the asking price delta and infusing creativity into marketing strategies have proven less impactful compared to the Western counties, where such tactics have demonstrated more tangible results. As we continue our quest for the right pricing strategy in these countries, the prospect of improved economic factors, often observed in election years, may expedite this process, but only time will tell.

Conclusion

As revealed by the data, the Western submarkets concluded the year positively, outperforming the preceding three quarters, with a surprise in the $5M+ market. As we step into the landscape of 2024, the unfolding trends hold our attention, especially as economic dynamics tend to shift in an election year. The Eastern subregion encountered challenges throughout 2023; its trajectory will become more evident in 2024 as we continue to strive to enhance visibility and engagement. Overall, my outlook for 2024 is optimistic; I anticipate a gradual upward trend in prices across the state, aligning with historical patterns pre-COVID. Despite lower transaction levels in 2023, the sales of higher-priced ranches have helped maintain total volume numbers close to pre-COVID levels. Looking ahead, I foresee a potential uptick in transaction numbers in 2024, particularly if the Federal Reserve decides to reduce rates. Third-party financing typically influences the $1-2M range as this range the most. This is why I am bullish on increased transaction totals, as this range accounts for a large portion of the market transactions. The coming year promises to be an intriguing chapter in the Texas recreational land markets.