By: Jeff Boswell, Partner/Broker Associate

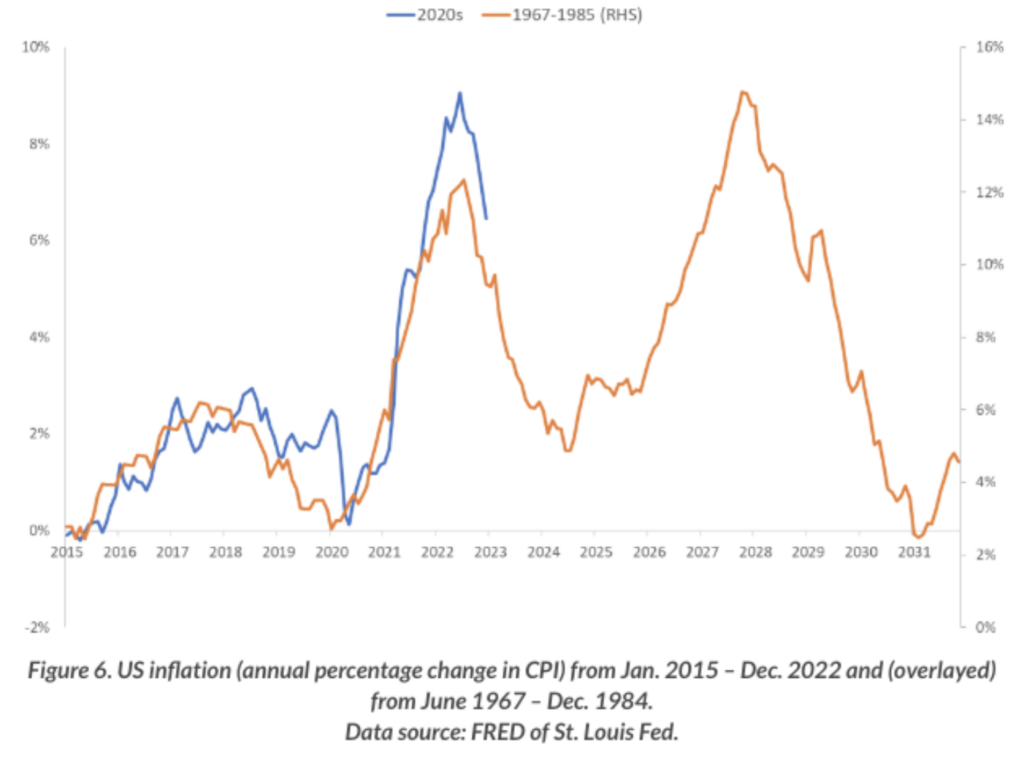

It is often said that history does not repeat but it does rhyme. In the early ’70s, the world was hit with its largest bout of inflation since WWII which was followed by years of malaise with inflation going through a second bout of highs after a short dip in the middle of the decade. There was a lack of leadership in Washington D.C., urban crime made many of our cities dangerous and we had just been embarrassed on the world stage evacuating Vietnam (Afghanistan anyone?). Well, welcome to the 2020s.

“The interest is up and the stock markets down and you only get mugged if you go downtown”

Hank Williams Jr., 1981

Has the inflation dragon been slayed? Frankly, I doubt it. Once inflation gets cranking, it can be very difficult to get the liquidity out of the system to sustain lower inflation over time with politicians refusing to hurt the economy enough to get the job done until things become unsustainable. I think the double peaks in the ’70s show that exactly and I expect we’re likely to see it again with this most recent bout. The fed will be forced to blink in the next year and inflation will return, even if they get the chance to blink before its re-emergence.

So where can you invest to protect your wealth? While obviously self-serving, I would argue that rural land is one of the best assets to protect your money from inflation and potential stagflation. Hard assets are typically seen as the best protection from inflation. A hard asset is a physical or tangible asset, rather than one that is intangible. They tend to preserve their value over times of inflation as they typically increase in dollar value at a similar rate as inflation. For a hard asset to do this consistently over time, it must be relatively scarce and hard to reproduce so that it can hold its value. A fleet of trucks is considered a hard asset, but someone can produce more trucks and flood the market, which will invariably reduce that asset’s value. As Mark Twain once said, “Buy land, they are not making any more of it.” One can mine more gold, paint more art, and build more warehouses, but no one is going to produce more raw land. It is the ultimate restriction of inventory of any hard asset.

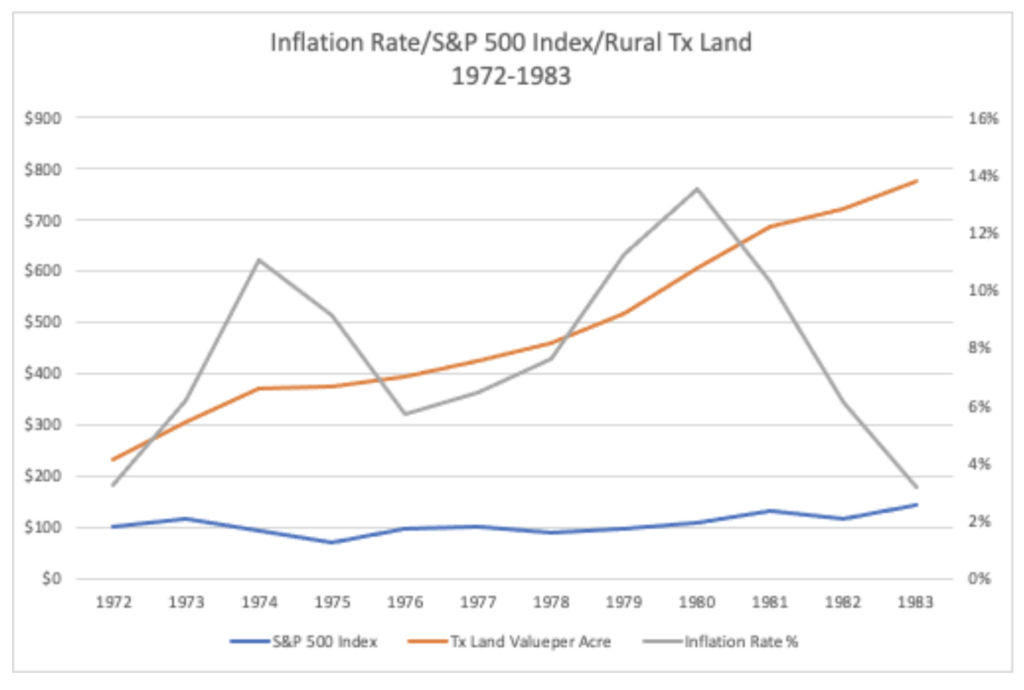

Looking back during the bout of inflation in the ’70s, I have charted the S&P Index and the average value per acre of Texas land against the rate of inflation. As can be seen, during the 12-year period (the time encompassing the inflation highs), the S&P Index went from 103 to 144 at the end of this period. That is an increase of 40% in 12 years or just over 3% per year in a time that saw an average rate of 8% inflation over that period. During the same time period, rural land in Texas went from $232/acre up to $776/acre. That is an overall increase of 234% or over 19% annually. As can be clearly seen, rural land kept well ahead of the inflation rate, while the S&P 500 lagged behind inflation during this period.

There are several disadvantages to rural land as an investment, such as liquidity and the amount of variability of land values (we are just using averages over the entire state), and some level of operating/carry cost. Regardless, it was shown in the ’70s to be not only a great inflation hedge but clearly a much better investment than stocks. Could this happen again? So far the S&P has kept up with inflation as has land, but from where I sit, we still have a long rocky road ahead.

Land also has some other wealth preservation advantages that are unique; there are few third-party risks in the ownership of rural land. Stocks go bankrupt, bonds default and both commercial and residential real estate have much more variability than land. Land is the ultimate finite resource whose value is very difficult to undermine.

“Cause your dollar ain’t shit and it’s taxed to no end cause of rich men north of Richmond”

Oliver Anthony, 2023